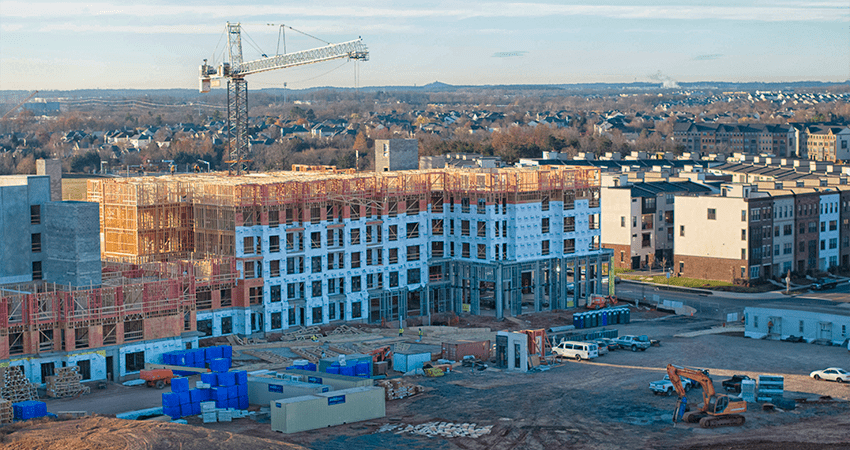

Gerville, Getty Images

Shaping the Opportunity Zone Map to Drive Housing Production That Best Meets Community Need

America faces a severe housing shortage. From the heartland to the coasts, the lack of moderately priced, well-built homes leaves millions struggling for stability. Rising electricity prices and increasing insurance costs fueled by climate-driven extreme weather are only deepening the squeeze.

Local leaders need every tool available to tackle this crisis. The federal Opportunity Zones (OZ) program was intended as an economic growth and job creation program, but something funny happened along the way—it largely has become a housing investment program.

Originally created in the 2017 Tax Cuts and Jobs Act, OZs are a package of federal tax incentives provided to investors if they invest their capital gains in designated lower-income communities. Having attracted perhaps $140 billion in investment in the first round of the program, OZs were reupped under the 2025 One Big Beautiful Bill Act.

Governors will be selecting new OZs in July 2026, and local leaders must lay the groundwork now to best position their cities to maximize the likelihood of attracting OZ investment that aligns with their communities’ priorities and needs. Here’s what they should be thinking about.

What to expect

Unfortunately, there is much that OZ investment cannot or will not do with respect to housing. If local leaders understand what OZs will and won’t deliver, this will help them positively influence the governors’ zone selection process and craft local incentives to attract desirable investments.

Given limited federal data reporting, we have incomplete insights into the operation of the OZ program, but several studies are starting to give us a picture of how and where OZ investment flows, with findings that local leaders should consider when thinking about how this investment incentive could be leveraged locally:

- A majority of OZ investments are in multifamily rental housing. Though we lack national data, in Ohio, where data are available, 64 percent of OZ investments went to housing or mixed-use projects, and most of that went to multifamily housing.

- Most OZ housing rents are higher than surrounding local market rents. Rent for roughly three out of four (78 percent) units in OZ-supported multifamily developments exceeded the median rent of the census tract.

- OZ investors are focused on investments that can achieve significant appreciation. The largest economic incentive of OZs is to start with a low capital account and exit with the highest gain possible (and avoid capital gains taxes on that appreciation).

- OZ capital is not often present in below-market rent (subsidized) projects. OZs are hard to pair with other subsidies and programs, such as the low-income housing tax credit, and timeline and financial return expectations are often different for these projects.

- OZ investment flows to areas where private investment is already going. Most OZ investment has flowed into neighborhoods that were in the top quintile of commercial investment and multifamily housing investment (PDF). In addition, OZ investment concentrates in neighborhoods with growing populations and increasing home values.

- OZ projects involve new construction or significant rehabilitation. There is a substantial improvement test under the program that means OZ projects will be new construction or significant rehab. This has important implications for housing and represents an opportunity to add incentives, requirements, and strategies that address long-term housing costs, including efficiency measures that keep utility and operating costs low, as well as siting and building methods that improve insurability and protect housing from flooding and other extreme weather events.

- OZ investment is a capital source and largely not able to be regulated locally. However, local leaders do have influence over housing projects that use OZ capital in terms of permitting, land use, tenant protections, and other local housing policies.

What local leaders can do now

Starting in July 2026, governors will select which specific census tracts are designated under the new eligibility criteria for OZs and will have the ability to designate up to 25 percent of the eligible tracts in a state as OZs.

The eligibility criteria have been tightened compared with the 2017 law. To be eligible, a tract must be a “low-income community.” In other words, it must either have a median family income not exceeding 70 percent of the metropolitan area or state (as relevant) median family income or have a poverty rate of at least 20 percent and a median family income not exceeding 125 percent of the metropolitan area or state (as relevant) median family income. Tracts contiguous to low-income community tracts will no longer qualify as they did under the 2017 law.

Local leaders should be thinking now about how they can influence the selection of OZs and attract the kind of OZ investment that will most benefit their communities through the following:

- starting conversations with their governor’s office to understand the process and criteria they will use to select tracts in 2026

- understanding where the new OZ-eligible tracts are likely to be

- assessing how eligible tracts align with existing city and community investment plans and priorities (such as a city’s climate action plan or comprehensive plan), as well as the plans and priorities of local partners, especially businesses and anchor institutions such as universities or hospitals, that may be allies in advocating for designations

- understanding where OZ investments have previously gone and the outcomes the program has generated locally

- identifying local incentives they could offer to OZ investors to attract the kind of housing and other investment their communities most need

By taking these steps now, local leaders can help make best use of the updated OZ program. The challenge for local leaders is how to take advantage of the OZ incentive in a way that will attract not just any investment, but specifically investment that will also create moderately priced, energy-efficient, and resilient housing and other benefits (such as jobs) that will improve the day-to-day lives of their constituents.